On the 1%

Since I'm not pulling in the original, go here to see what I'm responding to.

Ok. So I'm going to respond to this. If, for whatever reason I can't, then I'm going to repost it on my own site and respond to it there with implied verbal consent instead of explicit written consent.

Ok. So I'm going to respond to this. If, for whatever reason I can't, then I'm going to repost it on my own site and respond to it there with implied verbal consent instead of explicit written consent.

Claim 1: The Poor Are Doing Just Fine

|

Yeah. They're not. My wife and I have a combined 6-figure income and even we aren't doing so great (trying to figure out how to swing having a child while having one of us stay home). I can't imagine how others make ends meet.

If a 1% says that, they're almost certainly full of shit except that all boats have been raised... somewhat, but the distribution is very skewed. The problem isn't with earned wealth, it's with unearned wealth. While a hell of a lot of that can be laid at the feet of (the unnecessary kind of) government regulation and crony capitalism, there are other factors which keep people poor against their will. One example of the latter is the distribution of natural resource ownership in The United States. On the other hand, some people CHOOSE to be poor. They make bad life choices or they're just lazy and stupid. Sorry to be an asshole, but that's only my concern when it affects me. If people want to live a more bohemian existence and get a different kind of utility out of their lives, it's morally presumptuous for me to interfere. |

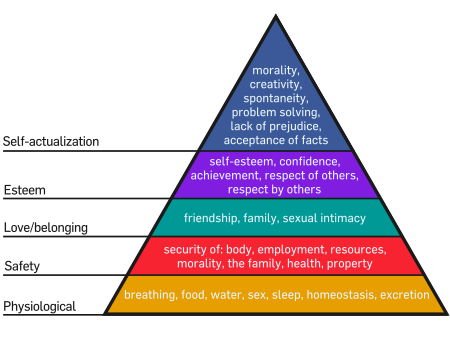

The word "NEED" has two and only two legitimate uses. The first is a prerequisite. The second is a misuse of the word "want." Humans NEED to eat to stay alive. Humans NEED to have linen shirts to look stylish in linen shirts. It sounds stupid when one says it that way, even though it's true. What people are really saying is that they WANT to eat (or WANT to survive) and believe that that is more important than less universal or pressing wants (even though the other party doesn't have those wants activated at that specific moment).

Claim 2: Rich People Work Harder, They Deserve What They've Earned

That sounds like a strawman though I've heard rich people say dumb things like that. The labor theory of value is crap. The labor theory of property is pretty decent so long as it's "appropriately bounded." The rich (who actually earn it) are doing things which are in more demand from others, and others thus "vote" by giving the rich their dollars ceding power so the rich can create the world the rich want.

|

However, the rich often DO work harder - giving up a lot. While people work secure 9 to 5 jobs and work on their marriage and see their children, some rich sacrifice those things for the sake of making money. They don't demand time with YOUR wife and YOUR children because you have an unfair "quality of family life wealth" and should contribute your fair share. Why is it fair to turn that around on them?

Now, it's also the case that a lot of the rich are born into wealth or steal it through legal means. I don't support the latter. I'm mixed on the former though I'd argue that, within a few generations, monetary wealth would evaporate if people stopped borrowing money from the rich. Wealth in the form of natural resources (including parcel land) undergirds all other opportunities and is a legitimate problem which I mentioned in #1. |

My wife and I could've screwed off in or after school. We worked for it and got ahead. I'm under no illusions that the results are completely due to my efforts (I don't think I'd have done as well in Somalia), but they are SIGNIFICANTLY due to the efforts of my wife and I.

Rather than attacking the rich versus poor, I'd rather focus on earned versus unearned wealth. The very rich tend to have a lot of unearned wealth in their portfolios. THAT'S what should be attacked, not the fact that they're rich. If someone had a billion dollars that they legitimately earned, I'd propose a tax rate of 0% on that money so long as there was even $1 of reasonably recoverable unearned wealth which wasn't clawed back.

Yes, luck is a part of all success. I had the good fortune to have loving parents and not be born with a disability. But luck falls pretty equally; there are ALWAYS opportunities presenting themselves. To try to "tax luck" will always cost more than it benefits overall. A better approach than sour grapes is to find human-placed roadblocks to opportunity access and remove them. The roadblock preventing legal dumping of toxic waste in rivers - let's keep that one. The one preventing people from cutting hair without a license - get rid of it!

Working harder doesn't mean you deserve more. Someone who's constipated can work really hard but I doubt they'll get paid well for what they produce. If you're not doing what people want, don't expect much compensation.

Rather than attacking the rich versus poor, I'd rather focus on earned versus unearned wealth. The very rich tend to have a lot of unearned wealth in their portfolios. THAT'S what should be attacked, not the fact that they're rich. If someone had a billion dollars that they legitimately earned, I'd propose a tax rate of 0% on that money so long as there was even $1 of reasonably recoverable unearned wealth which wasn't clawed back.

Yes, luck is a part of all success. I had the good fortune to have loving parents and not be born with a disability. But luck falls pretty equally; there are ALWAYS opportunities presenting themselves. To try to "tax luck" will always cost more than it benefits overall. A better approach than sour grapes is to find human-placed roadblocks to opportunity access and remove them. The roadblock preventing legal dumping of toxic waste in rivers - let's keep that one. The one preventing people from cutting hair without a license - get rid of it!

Working harder doesn't mean you deserve more. Someone who's constipated can work really hard but I doubt they'll get paid well for what they produce. If you're not doing what people want, don't expect much compensation.

Success if far but guaranteed, but any of the following almost guarantee failure in The United States.

1. Don't drop out of high school.

Yes, compulsory school is almost entirely a waste of time, but there's some shit you have to wade through.

2. Don't get addicted to drugs.

And that includes alcohol. Using is okay, letting it run your life not so much. Also, don't get caught. The drug war is dumb, but it's something you have to deal with.

3. Don't get someone pregnant until you're in a stable situation, and preferably married

Kids are expensive and time-consuming. You can spend your early 20's gaining more skills and earnings potential. Also, if you don't take care of your kid, that'll affect me and I don't like that. Condoms are hella-cheap.

Yes, compulsory school is almost entirely a waste of time, but there's some shit you have to wade through.

2. Don't get addicted to drugs.

And that includes alcohol. Using is okay, letting it run your life not so much. Also, don't get caught. The drug war is dumb, but it's something you have to deal with.

3. Don't get someone pregnant until you're in a stable situation, and preferably married

Kids are expensive and time-consuming. You can spend your early 20's gaining more skills and earnings potential. Also, if you don't take care of your kid, that'll affect me and I don't like that. Condoms are hella-cheap.

Counterpoint: some people had shit parents and genetic alcoholism or something. Fine, but they still shouldn't be subsidized if people want LESS of those things!

Claim 3: America is the Land of Opportunity; Poor People Just Won't Take Them

That's a true statement, but it's less true than I'd like it to be. Rich people often take opportunities I would argue they shouldn't (legalized theft, for instance).

I mentioned earlier that, if people stop borrowing money from the rich and stop letting them claim land without compensating others on a continual basis then they'd stop being rich because they wouldn't get interest or rent. As far as children of rich parents having better opportunities, what's the alternative? Subsidize failure? Public education (and most private education) is a joke. It doesn't take 12 years to learn how to read and do basic math. Few schools teach the trivium and logical thinking. Rote learning is practically useless in the age of Wikipedia.

Thankfully there's been a push for secular homeschooling and unschooling. Montessori and Sudbury schools are also filling some of the unmet need.

Poor people shouldn't be having children they cannot support. Someone's going to lose in that situation: the children, the children and the parents, or the children and society. I'm not a fan of punishing children for the sins of their parents, but that appears to be the reality.

On the other hand, I do support a basic income guarantee funded out of opportunity denial (e.g. rents, not an income tax or VAT). Estimates from various economists put this BIG around $10,000 per year per adult. Unlike welfare, there's no needs-based testing with a BIG, and there's no disincentive to work. I'd support eliminating all child subsidies at the same time.

Again, removing a lot of the UNNECESSARY regulations which keep people poor against their will would go a long way to letting the poor get ahead. If people want to be poor (e.g. the quintessential drug-abusing, multiple-children-from-different-fathers welfare mom gestalt), then I don't think it's right to force others to make them not poor. The first people to the top started kicking rungs out of the ladder to secure their position. FIX THE LADDER!

Lest you think I'm heartless, I find corporate welfare to be a FAR LARGER problem than individual welfare - even if the latter costs more directly if social security and medicaid are considered welfare. Each person making under $72,000 in the U.S. is paying about $6,000 a year in corporate subsidies (on top of the cost of services). People making more than that are paying even more. That's definitely not cool.

I mentioned earlier that, if people stop borrowing money from the rich and stop letting them claim land without compensating others on a continual basis then they'd stop being rich because they wouldn't get interest or rent. As far as children of rich parents having better opportunities, what's the alternative? Subsidize failure? Public education (and most private education) is a joke. It doesn't take 12 years to learn how to read and do basic math. Few schools teach the trivium and logical thinking. Rote learning is practically useless in the age of Wikipedia.

Thankfully there's been a push for secular homeschooling and unschooling. Montessori and Sudbury schools are also filling some of the unmet need.

Poor people shouldn't be having children they cannot support. Someone's going to lose in that situation: the children, the children and the parents, or the children and society. I'm not a fan of punishing children for the sins of their parents, but that appears to be the reality.

On the other hand, I do support a basic income guarantee funded out of opportunity denial (e.g. rents, not an income tax or VAT). Estimates from various economists put this BIG around $10,000 per year per adult. Unlike welfare, there's no needs-based testing with a BIG, and there's no disincentive to work. I'd support eliminating all child subsidies at the same time.

Again, removing a lot of the UNNECESSARY regulations which keep people poor against their will would go a long way to letting the poor get ahead. If people want to be poor (e.g. the quintessential drug-abusing, multiple-children-from-different-fathers welfare mom gestalt), then I don't think it's right to force others to make them not poor. The first people to the top started kicking rungs out of the ladder to secure their position. FIX THE LADDER!

Lest you think I'm heartless, I find corporate welfare to be a FAR LARGER problem than individual welfare - even if the latter costs more directly if social security and medicaid are considered welfare. Each person making under $72,000 in the U.S. is paying about $6,000 a year in corporate subsidies (on top of the cost of services). People making more than that are paying even more. That's definitely not cool.

Claim 4: If You Tax Rich People, They'll Stop Working

Oh, the 91% marginal income chestnut.

I knew it'd come out. Progressives love to point to that as if it's the final proof that taxes don't correlate with effort. Three things:

1. The marginal tax rate is not the effective tax rate. The effective tax rate was arguably NEVER that high. The rich exploited loopholes and, SUPRISE!, took over the government - BECAUSE IT WAS CHEAPER THAN PAYING 91%!

2. Europe was ruined after WWII and China was crap. Capital had nowhere to flee to. Now there are FAR more options for someone with capital. There are even more options for citizens (who can't flee as easily as capital and thus tend to be taxed at higher rates).

3. People had a post-WWII nationalism boner. Fleeing the country would've been seen as unamerican. Much fewer people are burdened with the religion of nationalism now.

Stop using the 91% thing because it makes you look ignorant. Hell, I'VE turned down contract jobs because I didn't feel like paying the 1099 amount.

While we might be on the left side of the Laffer curve currently, I'd bet you my house that the right side is WAY before 83%. Look at the rich bailing from France to go to Belgium. As stilted as Ayn Rand's writing was, I think she correctly predicted the brain drain and producer loss which happens at extremely high tax rates.

Here's a better solution - tax exclusive ownership of resources. Oil, the EM spectrum, land, minerals, fishing rights, water rights. Not only does that lead to people not using more than they need (and almost completely eliminating speculation in those things - one of the causes of the recurring 18 year boom/bust cycles), but the FIRE sector can raise between 25% and 33% of GDP in taxes. Not that I think the government needs that much anyways - and it certainly wouldn't if opportunities were opened up and education was made more efficient (10k per pupil per year, really?)

1. The marginal tax rate is not the effective tax rate. The effective tax rate was arguably NEVER that high. The rich exploited loopholes and, SUPRISE!, took over the government - BECAUSE IT WAS CHEAPER THAN PAYING 91%!

2. Europe was ruined after WWII and China was crap. Capital had nowhere to flee to. Now there are FAR more options for someone with capital. There are even more options for citizens (who can't flee as easily as capital and thus tend to be taxed at higher rates).

3. People had a post-WWII nationalism boner. Fleeing the country would've been seen as unamerican. Much fewer people are burdened with the religion of nationalism now.

Stop using the 91% thing because it makes you look ignorant. Hell, I'VE turned down contract jobs because I didn't feel like paying the 1099 amount.

While we might be on the left side of the Laffer curve currently, I'd bet you my house that the right side is WAY before 83%. Look at the rich bailing from France to go to Belgium. As stilted as Ayn Rand's writing was, I think she correctly predicted the brain drain and producer loss which happens at extremely high tax rates.

Here's a better solution - tax exclusive ownership of resources. Oil, the EM spectrum, land, minerals, fishing rights, water rights. Not only does that lead to people not using more than they need (and almost completely eliminating speculation in those things - one of the causes of the recurring 18 year boom/bust cycles), but the FIRE sector can raise between 25% and 33% of GDP in taxes. Not that I think the government needs that much anyways - and it certainly wouldn't if opportunities were opened up and education was made more efficient (10k per pupil per year, really?)

Claim 5: Inequality Drives Innovation

It does: deal with it. But it creates negative consequences too. Pick the point you find optimal, but don't deny the evidence.

Too much inequality increases all the "bad" things in society. The Gini coefficient is a pretty decent predictor of the health of an economy. However, like a mechanical system, action occurs BECAUSE of disequilibrium. If everyone had exactly the same things and wanted for nothing, then no one would trade with one another... ever. When Apple produces iPods, suddenly they have more iPods than they want and others have a desire for iPods and more money than they want. A trade occurs. Inequality is a natural result.

If trade isn't necessary, trading of ideas tends to fall off too because why the hell do you need to interact with others. Less interaction with others, less innovation. While there are ways to have lower inequality without reducing the incentive to innovate (as much), the ways I've heard many progressives propose will blunt innovation. Certain sectors, of course, will not be blunted as much (e.g. open source software), while others will be blunted greatly (heart surgeons, janitors).

Also, why do you bring up incremental improvements? Are you on the luck thing again? Only Randroids believe in the hero inventor myth. That doesn't mean the money should go to everyone equally? Are you responsible to everyone every time you use calculus? Or are you just responsible to Newton's heirs? Why can't it be a positive externality? For the record, I have a lot of problems with patents and a fair amount with copyright. Beyond that, what does the destruction of that myth have to do with the price of tea in China?

If CEOs don't do much then investors and companies are stupid for paying them as highly as they do. Unless there's some force making it necessary to pay them highly, over time smart companies will figure out that they can cut that unnecessary expense and then other companies will have to adapt or die. Yet this doesn't appear to be happening. Are you saying the majority of companies are run by stupid people?

Justin Bieber makes more than Normal Borlaug because people value his work more highly or are simply ignorant of the work Borlaug did in genetically engineering crops. You don't get to pretend that there's an OBJECTIVELY CORRECT answer as to which has more worth... because there isn't.

And I already addressed luck, stop having a sour grapes complex. Arnold Palmer famously said "It's a funny thing, the more I practice the luckier I get." Remove the human-imposed roadblocks to success. That's THE BEST you can do without cannibalizing the opportunities from others or claiming your values are "the one correct set."

Too much inequality increases all the "bad" things in society. The Gini coefficient is a pretty decent predictor of the health of an economy. However, like a mechanical system, action occurs BECAUSE of disequilibrium. If everyone had exactly the same things and wanted for nothing, then no one would trade with one another... ever. When Apple produces iPods, suddenly they have more iPods than they want and others have a desire for iPods and more money than they want. A trade occurs. Inequality is a natural result.

If trade isn't necessary, trading of ideas tends to fall off too because why the hell do you need to interact with others. Less interaction with others, less innovation. While there are ways to have lower inequality without reducing the incentive to innovate (as much), the ways I've heard many progressives propose will blunt innovation. Certain sectors, of course, will not be blunted as much (e.g. open source software), while others will be blunted greatly (heart surgeons, janitors).

Also, why do you bring up incremental improvements? Are you on the luck thing again? Only Randroids believe in the hero inventor myth. That doesn't mean the money should go to everyone equally? Are you responsible to everyone every time you use calculus? Or are you just responsible to Newton's heirs? Why can't it be a positive externality? For the record, I have a lot of problems with patents and a fair amount with copyright. Beyond that, what does the destruction of that myth have to do with the price of tea in China?

If CEOs don't do much then investors and companies are stupid for paying them as highly as they do. Unless there's some force making it necessary to pay them highly, over time smart companies will figure out that they can cut that unnecessary expense and then other companies will have to adapt or die. Yet this doesn't appear to be happening. Are you saying the majority of companies are run by stupid people?

Justin Bieber makes more than Normal Borlaug because people value his work more highly or are simply ignorant of the work Borlaug did in genetically engineering crops. You don't get to pretend that there's an OBJECTIVELY CORRECT answer as to which has more worth... because there isn't.

And I already addressed luck, stop having a sour grapes complex. Arnold Palmer famously said "It's a funny thing, the more I practice the luckier I get." Remove the human-imposed roadblocks to success. That's THE BEST you can do without cannibalizing the opportunities from others or claiming your values are "the one correct set."

Claim 6: Inequality is An Inevitable Consequence Of the Information Economy

Uh, yeah it is (without redistribution). Information is a new paradigm and unskilled labor is less valuable - especially thanks to automation. Unionization is at best a stop-gap measure. I fully support indiviuals who want to form private unions. I also support the ability for employers to fire them all. I completely reject public unions - hell, even cannonized progressive saint FDR rejected public unions.

People don't want to hold government accountable. Some also want things like 91% tax rates and wonder why capital flees the country or lobbyists start working overtime. Some want centralized top-down government and wonder why money is so prevalent in politics.

Equality and liberty don't have to be at odds in all cases, but often are. I pointed out at least twice what I think the root of the problem is (human opportunity denial) and proposed a solution which is compatible with liberty. Otherwise, inequality is the price one pays for liberty and I choose liberty because I'm capable so it's rational for me to do so. The veil of ignorance is irrational once you know where you are.

People don't want to hold government accountable. Some also want things like 91% tax rates and wonder why capital flees the country or lobbyists start working overtime. Some want centralized top-down government and wonder why money is so prevalent in politics.

Equality and liberty don't have to be at odds in all cases, but often are. I pointed out at least twice what I think the root of the problem is (human opportunity denial) and proposed a solution which is compatible with liberty. Otherwise, inequality is the price one pays for liberty and I choose liberty because I'm capable so it's rational for me to do so. The veil of ignorance is irrational once you know where you are.

You ARE the 1%

... if you make more than $46,000 dollars a year! Oh, but that's out of the whole world! Yeah, but why should I limit my caring only to the U.S.? Why not go beyond that, or go even smaller, to my province, town, or family? Because Obama? When you understand why you don't give your discretionary income to people in Africa, you'll understand why I don't give poor people in the U.S. mine.

Fuck you, buddy.

Fuck you, buddy.